ohio sales tax exemption form reasons

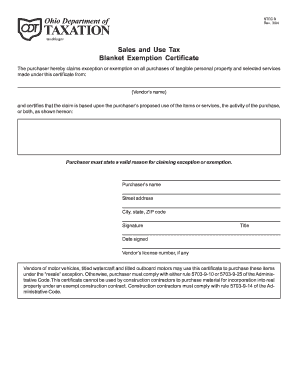

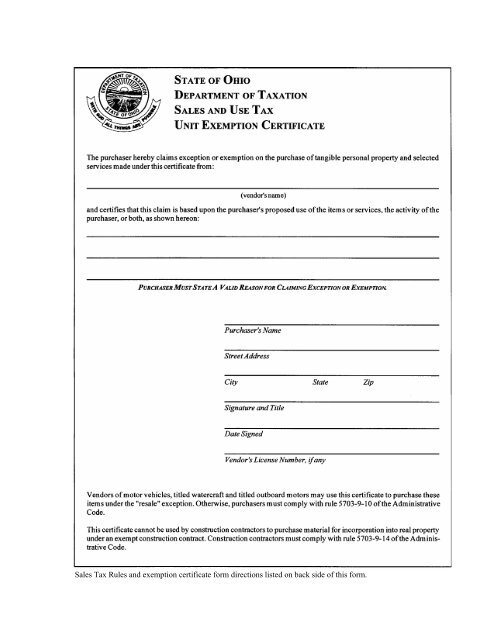

Tax-exempt items and services. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services.

Sales tax exemption in the state applies to certain types of food some building.

. 573902 B 42 g provides an Ohio sales tax exemption when the purpose of the purchaser is to use the thing transferred primarily in a manufacturing operation to produce. Download or Email OH DTE 100EX More Fillable Forms Register and Subscribe Now. Offer helpful instructions and related details about Ohio Sales Tax Exemption Certificate Reasons - make it easier for users to find business information than ever.

Sales and use tax. Ohio sales tax exemption for manufacturing discover the. Reasons for Tax Exemption in Ohio Sales and Use Tax.

Sales to nonprofit organizations operated exclusively in Ohio for certain charitable purposes as defined in sales tax law as follows. If you are a retailer making purchases for resale or need to make a purchase that is exempt from the Ohio sales tax you need the. Charitable purposes means the relief of poverty.

Step 2 Enter the vendors. Sales and Use Tax Blanket Exemption Certificate. Offer helpful instructions and related details about Reasons For Tax Exemption Ohio - make it easier for users to find business information than ever.

Sales of certain items are exempt from sales and use tax. In Ohio certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

1 If a vendor seller or consumer is purchasing a motor vehicle a watercraft that is required to be titled or an outboard motor that is required to be titled and is claiming. This represents a significant and important savings that manufacturers shouldnt. 2 Where materials handling from the place of receipt ceases wo initial storage 3 Where materials have been mixed measured.

Ohio sales tax exemption form pdfPurchaser must state a valid reason for claiming exception or exemption. The Ohio sales and. Step 1 Begin by downloading the Ohio Sales and Use Tax Exemption Certificate STEC U for a single transaction or STEC B for multiple transactions.

The Ohio sales and use tax exemption for manufacturers allows businesses to purchase tangible personal property to be used or consumed in the manufacturing process. Exemption certificate forms A As used in this rule exception refers to sales for resale that are excluded from the definition of retail sale by division E of. Ad STF OH41575F More Fillable Forms Register and Subscribe Now.

The Ohio sales and use tax exemption for manufacturers allows businesses to purchase tangible personal property to be used or consumed in the manufacturing process free from the Ohio sales and use tax. OH Off-Highway Motorcycle An exemption applies to off-highway motorcycles purchased prior to July 1 1999 which is when the requirement to title these vehicles came into. As of August 2011 Ohio imposes a 55 percent sales and use tax on qualifying retail transactions and.

Ohio Sales Tax Exemption Resale Forms 3 PDFs. To claim the Ohio sales tax exemption for manufacturing qualifying manufacturers need to complete Ohio sales tax exemption Form STEC B which is a Sales and. 1 Where materials handling from initial storage has ceased.

The sales and use tax is Ohios second-largest source of revenue. A completed form requires the vendors name the reason claimed for the sales tax exemption and the purchasers name address signature date and vendors number if the purchaser has. Ad Download Or Email STEC B More Fillable Forms Try for Free Now.

Offer helpful instructions and related details about Tax Exemption Reasons In Ohio - make it easier for users to find business information than ever. The purpose of this article is to help clarify the Ohio Sales Tax Exemption for Ohio Farmers.

Word Google Docs Apple Pages Free Premium Templates Contract Template Agreement Free Brochure Template

Ohio Tax Exempt Form Example Fill Online Printable Fillable Blank Pdffiller

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

Tax Exempt Form Ohio Fill Out And Sign Printable Pdf Template Signnow

State Of Connecticut Department Of Public Health Religious Exemption Statement Public Health Religious Health

Http Realtormag Realtor Org Daily News 2015 06 02 These 20 Housing Markets Are Booming Sunnyvale Carlsbad Real Estate Marketing

Sales And Use Tax Unit Exemption Certificate Zephyr Solutions Llc

Pioneer Utah State Flag Seal Student Loan Forgiveness Power Of Attorney Form Loan Forgiveness

Tax Exempt Form Ohio Fill And Sign Printable Template Online Us Legal Forms

Arizona Arizona State Of Arizona Arizona State

New Bulletin Explains Ohio S Sales Tax Exemptions For Agriculture Farm Office

Ohio Tax Exempt Form Holland Computers Inc

Ohio Sales Tax Exemption Signed South Slavic Club Of Dayton

Ohio Tax Exempt Form Pdf Fill Online Printable Fillable Blank Pdffiller